Recording begins from the moment an agent answers the call and continues until the line is disconnected, including any time spent on hold. These call recordings are used to evaluate the quality and accuracy of agents’ responses, identify call trends, and provide insight into potential areas in which training would be beneficial. The Canada Revenue Agency’s (CRA) call centres record some calls.

%2C+you+can+activate+an+RM+account+by+contacting+the+Canada+Revenue+Agency+at.jpg)

Order 2019 tax packages (your SIN is needed to use this service).Get information about registered charitiesĭiscuss income tax payment arrangements with an agentĭiscuss Child and family benefits overpayments and make payment arrangements with an agent.ĭiscuss payment arrangements for debts owing to Human Resources and Skills Development Canada, such as defaulted Canada Student loans, Employment Insurance Overpayments, Employment Programs overpayments and Canada Pension Plan overpayments. Note: If you use an operator-assisted relay service, call our regular telephone numbers on this page instead of the TTY number. International tax and non-resident enquiriesĬall these numbers when you cannot access My Account or Quick Access, or when you need help with NETFILE or Represent a ClientĬall these numbers when you cannot access My Business Account, or when you need help with GST/HST NETFILE, GST/HST TELEFILE, Filing Information Returns Electronically, Represent a Client, or Payroll Deductions Online CalculatorĬall these numbers when you need help with Corporation Internet Filingįor enquiries from persons who are deaf or hard of hearing, or who have a speech impairment. Order online or get phone numbers and hours of service

CANADA REVENUE AGENCY GST CONTACT NUMBER FREE

You can also use the toll free number to order

CANADA REVENUE AGENCY GST CONTACT NUMBER DOWNLOAD

Order publications online or download from the CRA site.

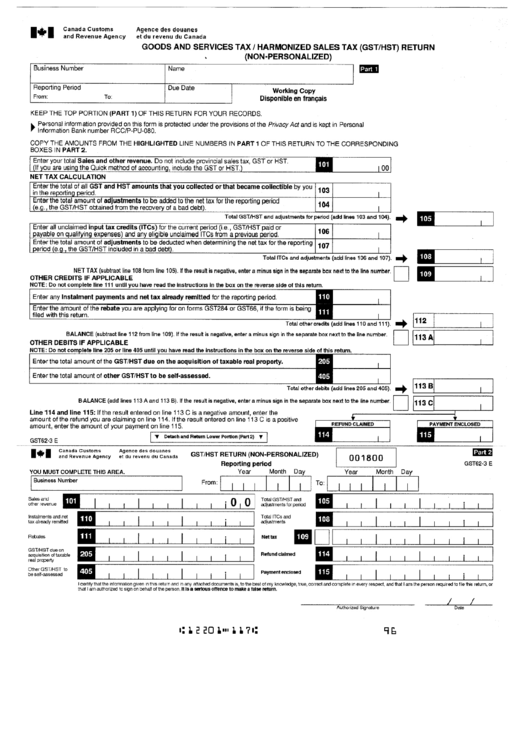

GST/HST credit and related provincial and territorial programsĮnquires related to Ontario Sales Tax Credit (OSTC), Ontario Sales Tax Transition Benefit (OSTTB), Ontario energy and property tax credit (OEPTC) payment, Northern Ontario energy credit (NOEC) payment, and Ontario Senior Homeowners' Property Tax Grant (OSHPTG) payment. UCCB, CCTB and related provincial and territorial programs, child disability benefit and children's special allowances Universal Child Care Benefit, Canada Child Tax Benefit This automated phone service provides information about your income tax refund.īusiness and GST/HST registration, payroll, GST/HST (including rebates such as the new housing rebates), excise taxes and other levies, excise duties, corporations, sole proprietorships and partnerships Tax information for individuals and trusts, including personal income tax returns, instalments, RRSPs, and the Working Income Tax Benefit Individual income tax and Trust enquiries This automated phone service provides information to individuals and businesses Enquiries TIPS (Tax Information Phone Service)

0 kommentar(er)

0 kommentar(er)